Third: Commissions and Production costs:

The total commissions and production costs for the company during the financial year 2015/2016 amounted to 45411111 million Egyptian pounds by 10.52% of the written premiums issued, while in the previous year amounted to 32382724 million Egyptian pounds by 11.64% of the written premiums issued.

| Statement | Year 2015/2016 | Year 2014/2015 | ||

|---|---|---|---|---|

| Amount | Percentage of premiums | Amount | Percentage of premiums | |

| Commissions and Production costs | 45411111 | 10.52% | 32382724 | 11.64 % |

Fourth: General and Administrative Expenses:

The total general expenses during the financial year 2015/2016 amounted to 24800833 Egyptian pounds by 5.74% of the written premiums issued, while it reached in 30/6/2015 19258746 Egyptian pounds by 6.92%, a decrease of about 1.18% because of the reduction of the company's expenses and maximize the direct premiums.

| Statement | Year 2015/2016 | Year 2014/2015 | ||

|---|---|---|---|---|

| Amount | Percentage of premiums | Amount | Percentage of premiums | |

| General and Administrative Expenses | 24800833 | 5.74% | 19258746 | 6.92% |

This item includes 10333768 Egyptian pounds representing salaries, wages and in its judgment, by 41.66% of the value of general expenses compared to 8719358 Egyptian pounds in the previous year by 45.27%.

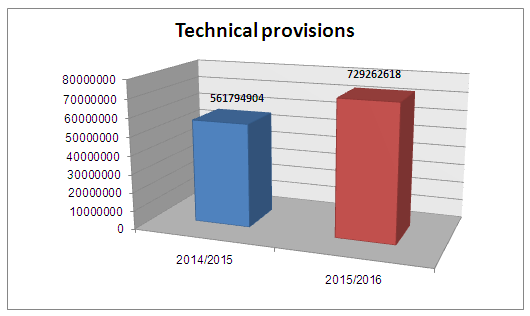

Fifth: Technical provisions:

The technical provisions at the end of the financial year 2015/2016 amounted to 729262618 Egyptian pounds compared to 561794904 Egyptian pounds, an increase of 167467714 Egyptian pounds, an increase rate of 30%.

| Statement | Technical provisions in 30/6/2016 | Technical provisions in 30/6/2015 | Increase | Increase percentage |

|---|---|---|---|---|

| Technical provisions | 729262618 | 561794904 | 167467714 | 30% |

Sixth: Account Receivables of Insurance Transactions:

| Statement | 2015/2016 | 2014/2015 |

|---|---|---|

| Outstanding Premiums | 16055545 | 18966795 |

| Postdated Cheques | 8865800 | 5198835 |

| Returned Cheques and lawsuit in court | 1223457 | 1209457 |

| Total | 26144802 | 25375087 |

| Account receivables of insurance transactions | (2110038) | (1729340) |

| Net | 24034764 | 23645747 |

The percentage of collections for the financial year 2015/2016 is about 97% of the written premiums compared to 95% of the previous year, which reflects the company's keenness on preserving the company funds and activating the collection constantly.

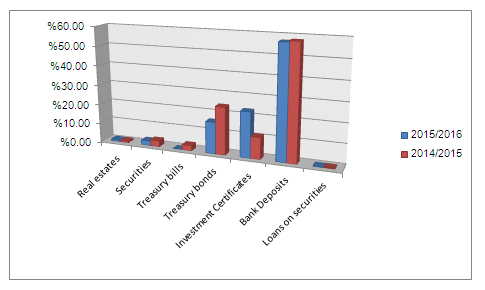

Seventh: Investments:

The total invested capital on 30/6/2016 amounted to 736597158 Egyptian pounds compared to 553524132 Egyptian pounds, an increase of 183073026 Egyptian pounds, an increase rate of 33%.

| Statement | 2015/2016 | relative weight | 2014/2015 | relative weight |

|---|---|---|---|---|

| Real estates | 6465201 | 0.88% | 4701583 | 0.85% |

| Securities (available for sale) | 5024900 | 0.68% | 5024900 | 0.91% |

| Treasury bills | 0 | 0% | 14897712 | 2.69% |

| Treasury bonds | 118420597 | 16.08% | 133692360 | 24.15% |

| Investment Certificates of New Suez Canal | 61000000 | 8.28% | 61000000 | 11.02% |

| Investment Certificates of National Bank Group B) | 105000000 | 14.25% | 0 | 0% |

| Investment Certificates of Société de Banque (Dollar) | 4385000 | 0.59% | 0 | 0% |

| Bank Deposits | 421761233 | 57.25% | 320400426 | 57.88% |

| Securities for trading | 12543217 | 1.70% | 12103226 | 2.19% |

| Loans on securities | 1997010 | 0.27% | 1703930 | 0.31% |

| Total | 736597158 | 100% | 553524132 | 100% |

These investments are distributed among the different investment channels and are determined by the EFSA as follows:

- Taking into consideration that to reach the highest return rates as well as the dimension of risk in these investments.

- Provide liquidity to meet the company's commitment to policy holders and beneficiaries.

Eighth: Company Results:

The company achieved an insurance activity surplus of 15.29 million Egyptian pounds compared to 6.66 million Egyptian pounds, an increase of 8.63 million Egyptian pounds, an increase rate of 130%.

Ninth: Year Profit:

The company's net profit for the financial year ended 30/6/2016 amounted to 11.75 million Egyptian pounds after tax deduction, compared to 7.56 million Egyptian pounds, an increase of 4.19 million Egyptian pounds, an increase rate of 55% over the financial year 30/6/2016.